Mastering the Digital Cryptocurrency Market: A Comprehensive Guide to Cryptocurrencies, Staking, Trading Indicators, and Trading Strategies

The world of cryptocurrencies has evolved significantly over the past decade, with the advent of blockchain technology and decentralized finance (DeFi) platforms. As a result, traders and investors can now participate in this market with unprecedented ease. In this article, we’ll delve deeper into the world of cryptocurrencies, exploring the concepts of staking, trading indicators, and trading strategies that can help you navigate this complex market.

Cryptocurrency 101: What is Cryptocurrency?

Before we dive into the technical aspects of cryptocurrencies, let’s quickly review what they are. Cryptocurrencies are digital or virtual currencies that use cryptography for security and are decentralized, meaning they are not controlled by any government or financial institution. The most well-known cryptocurrency is Bitcoin (BTC), but there are over 5,000 other cryptocurrencies in circulation.

Staking: A Key to Unlocking Passive Income

Staking is one of the most attractive features of certain cryptocurrencies like Ethereum (ETH) and Tezos (XTZ). Staking allows users to lock up their coins for a specific period of time in exchange for rewards. The idea behind staking is that the longer you hold your coins, the higher the likelihood of earning interest on them.

Here’s how it works:

- User Deposit: A user deposits their coins into a wallet.

- Staking Period: The wallet owner locks up their coins for a specific period of time (e.g. 30 days).

- Interest Earned

: During the staking period, the user earns interest on their deposited coins.

Trading Indicators: How to Make Informed Decisions

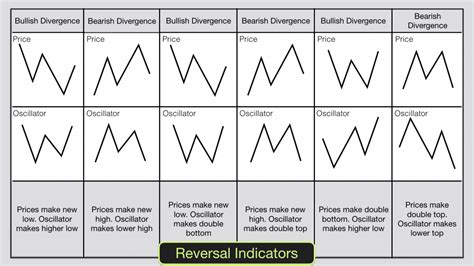

Indicators are tools used by traders to analyze price movements and make informed decisions about whether to buy or sell a specific cryptocurrency. There are several types of trading indicators, including:

- Moving Averages: A moving average is a chart that plots the closing price of an asset over a specified period (e.g., 50 days, 200 days).

- Relative Strength Index (RSI): The RSI measures the magnitude of recent price changes to determine overbought or oversold conditions.

- Bollinger Bands: This indicator plots moving averages with standard deviations, helping traders identify potential breakouts.

Trading Strategy: A Step-by-Step Guide

A trading strategy is a set of rules that guide your trading based on market analysis and risk management. Here is a basic framework for building a trading strategy:

- Define your goals: Determine what you want to achieve (e.g., short-term gains, long-term wealth).

- Choose your cryptocurrency: Select the cryptocurrency(s) you want to trade.

- Set your risk management: Determine your risk tolerance and stop-loss levels.

- Develop a trading plan: Create rules for entering and exiting trades based on indicators.

Example trading strategy

Here is an example of a trading strategy that uses staking as a key component:

- Buy Bitcoin (BTC): Buy 100 BTC at $10,000.

- Hold until end of staking period: Hold the coins for 30 days to earn interest.

- Sell with earned interest: Sell the BTC at $20,000 after earning interest.

- Use a stop-loss level: Set a stop-loss level of $15,000.

Conclusion

Mastering the digital cryptocurrency market requires knowledge, discipline, and a solid understanding of technical analysis and risk management. By incorporating staking into your trading strategy and using relevant indicators, you can increase your chances of success in this complex market. Remember to always do your own research and never invest more than you can afford to lose.

Additional Resources

- Cryptocurrency Trading Platforms: Consider using platforms like Coinbase, Binance, or Kraken for your cryptocurrency trading.

Leave a Reply