Technical Analysis Techniques for Crypto Traders

The world of cryptocurrency trading has become increased complex, with prices fluctuating rapidly and unpredictly. As a result, Traders Require Technical Analysis Techniques to Make Informed Decision and Stay Ahead of the Market. In this article, we will explore some of the most effective technical analysis techniques used by crypto traders.

1. Chart patterns

Chart patterterns are a fundamental tool in technical analysis, used to identify potential price movements and trends. Here are some common chart patterns used by Crypto Traders:

Head and shoulders

: A bullish or bearish pattern that forms when prices reach the upper or lower end of a range.

* triangle patterns : a pattern sideways -formed when prices bounce off each other, indicating a potential reveral in trend.

bearish engulfing : a reveral pattern where the price breaks below the previous low, signaling a downward trend.

2. Indicators and Oscillators

Indicators and oscillators are technical tools that help traders gauge market momentum and trends. Here are some popular Ones:

* Moving Averages (MA) : A time-weighted average of prices on a specified period, used to identify trends and breakouts.

Relative Strength Index (RSI) : A momentum indicator that measures the speed and change of price movements, indicating potential overselling or bidding.

* Bollinger Bands : A volatility-based indicator that shallly two moving averages with Standard deviations, used to gauge market risk.

3. Trend Lines

Trend lines are lines drawn on charts that connect the lowest and highest points of a trend. Here’s how to use them:

Moving Average Convergence Divergence (MACD) : A line that compares the speed of two trends, used to identify potential reversals.

* Stochastic Oscillator : A ratio or current price to its 14-day Moving Avage, used to gauge momentum.

4. Support and Resistance

Support and resistance are levels where prices tend to bounce or correctly in certain directions. Here’s how to use them:

Support Levels : The Lowest Level that a price touches before bouncing back.

* resistance levels : the highest level that a price touches before correcting downwards.

5. NEWS AND SENSIMENT Analysis

NEWS AND SENSIMENT ANASIS HELP TRADERS GAUGE MARKET REACTIONS TO IMPORTING EVENTS. Here are some sources of news:

Blogs and Online Articles

: Reputable sources like Coindesk, Bloomberg, and CNBC provide valuable insights into market trends.

* Social Media : Follow Industry Leaders and Influencers on Twitter, LinkedIn, or Facebook to stay informed about market Developments.

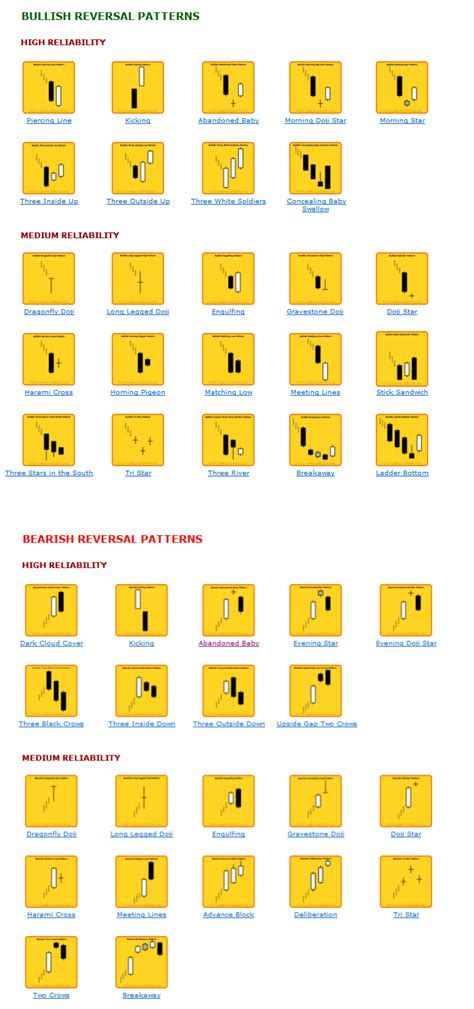

6. Candlestick patterns

Candlestick patternerts are graphical representations of price movements that help traders identify potential reversals. Here’s how to use them:

* Hammer Pattern : A bullish pattern where the price forms a hammer shape.

* Shooting Star Pattern : A bearish pattern where prices form a shooting star shape.

7. Price action analysis

Price action analysis involves studying the flow of prices duration an exchange, using techniques like chart patterns and indicators to identify potential reversals or continuations. HERE’S How to Analyze Price Action:

Price bounces : Study the price action after bounces, as these can indicate a trend reveral.

* Volume Cues : Analyze Volume Patterns, such as increasing or decreasing Volume Duration Breakouts.

8. Technical Indicator Breakdown

Technical Indicator Breakdown Involves Analyzing Each Technical Indicator Separately to Understand Its Strengths and Weaknesses. Here’s how to analyze indicators:

* indicator overlap : Compare the performance of different indicators.

* indicator crossovers : analyze when indicators cross over, as these can indicate a reveral potential.

** 9.

Leave a Reply