Forms of the extension: Daily Shop Guide to Crypto Currency

As a day of traders, you are constantly looking for patterns that can help you make informed investment decisions. One of the most effective ways to do this is the study of the continuation of the cryptocurrency markets. In this article, we will investigate what the sequel forms are, how they work and provide insights specially adapted to day traders.

What are the sequel samples?

The continuation patterns refer to a number of technical indicators that form when the price of property is still moving within a particular range or channel after it has erupted. These patterns can be used to identify potential trends, turnarounds and certificates. In the context of the cryptocurrency market, the continuation patterns exploit the natural tendency of the market to return to its middle reversion.

Types of continuing samples

There are several types of extensions used by traders:

- head and shoulder (H&S) : Classic pattern where the price forms the tip of the head and shoulder, followed by a fall to low.

- Reverse head and shoulders : similar to H&S, but with a reverse shape, often pointing to the turnaround.

- The extension of the range of the range (CSRB) : where the price breaks down from the channel or range, forming a sample of the extension.

- Samples of Diverenci Moving average convergence (MacD) : MacD signal combination and extension patterns to confirm trends.

How to identify the extension patterns in the Crypto currency

To notice the sequel for the cryptocurrency markets, follow these steps:

- Choose the right crypto currency : focus on popular cryptocurrency currencies like Bitcoin, Ethereum or Altcoin.

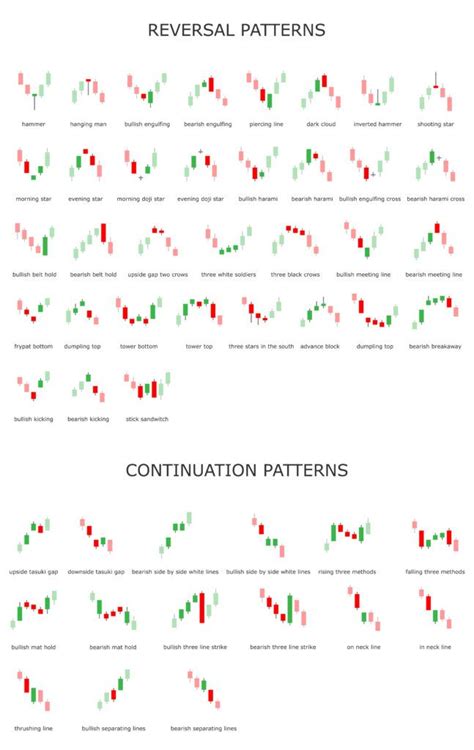

- Use technical indicators : Use tools such as charts, candles and moving average to identify potential extensions.

3

- Analyze trends and channel lines : understand the basic structure of the market and look for areas of support and resistance.

- Combine with other indicators : Use continuation patterns combined with other technical analysis tools, such as swing and volatility indicators.

How the sequel samples work

Pouring for the continuation work:

- Returning to meant reversion : CRIPTO currency turns to their historical means, often after a strong price movement.

- Picking of the established channels : prices form new high or downs within the established range, indicating a sequel.

- Formation of new extensions : Forms of the teaching extension can be used to confirm new trends and identify potential turns.

Example: The Bitcoin Continue Sample

Suppose you are watching Bitcoin price and notice a strong breakthrough above the upper Bollinger band. This could indicate that the market is likely to continue to move, forming the continuation pattern.

* Initial interruption : The price erupts from the channel, indicating a new maximum.

* Resistance to the trend line : The price forms a trend resistance level (eg 40,000) above which it can again test and potentially reverse.

* The continuation pattern : If the price is still moving more, you could see another sample continuation, such as the reverse head and shoulder at the top or the extension of the range of the range.

Conclusion

The continuation patterns are a powerful tool for daily traders in cryptocurrency markets. By identifying these patterns, you can gain insight into market trends and make informed investment decisions. Remember that you always combine technical analysis with risk management strategies and adjust your access to certain market conditions.

In this guide we covered the basics of continuing in the cryptocurrency markets.

Leave a Reply